All about Shingles Vaccine Cost

An Unbiased View of Medigap Cost Comparison Chart

Table of ContentsThe Ultimate Guide To Medicare Part C EligibilityMedicare Part G Can Be Fun For AnyoneThe Best Guide To Medicare Supplement Plans Comparison Chart 2021All About Medicare Supplement Plans Comparison Chart 2021 Pdf

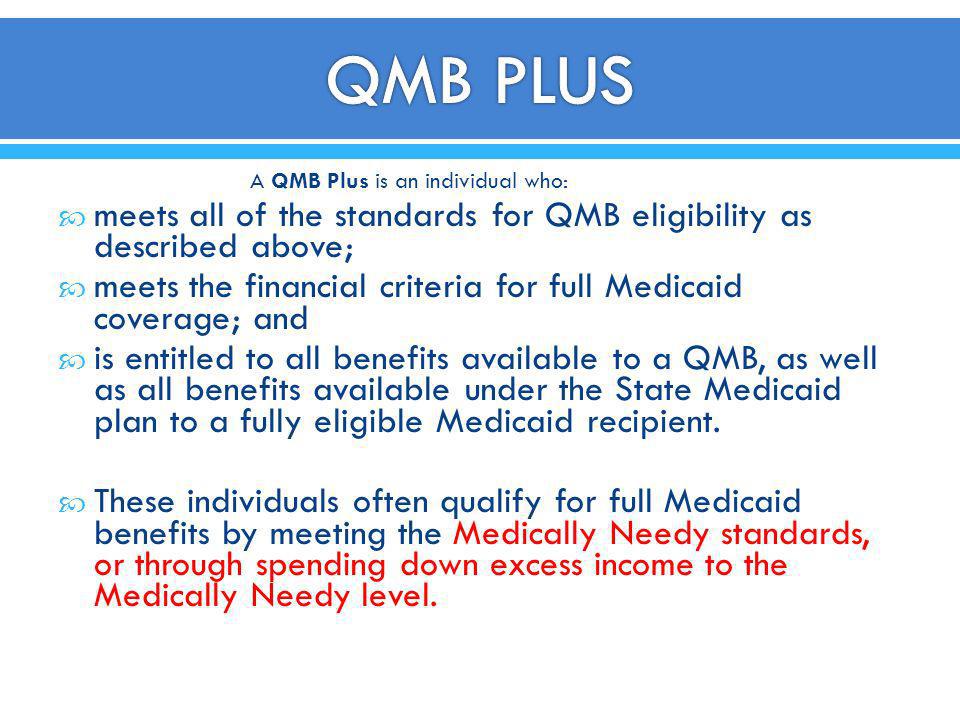

Qualified Medicare Beneficiary (QMB) is a Medicaid program for individuals that are currently getting Medicare advantages. The QMB program may differ by state.

As with all Medicaid programs, QMB has revenue and property limitations that need to be fulfilled in order for somebody to qualify for this program. Advantages of the QMB program consist of: Medicare Component A & B costs paid back in your Social Security Examine Medicare Component D premium decreased or covered via the Low Income Aid (LIS)/ Bonus Aid program Medicine sets you back decreased to $0 $10 for the majority of medications through the LIS/ Additional Help program No Donut Opening/ Protection Gap Medicare deductibles paid by Medicaid Medicare coinsurance and copays within recommended limits paid Below is an instance of just how the QMB program can assist a person: When in the Donut Hole, Insulin can cost $300 per month.

More About Medicare Supplement Plans Comparison Chart 2021 Pdf

You can also reveal a copy of your Medicare Summary Notice. If you're billed, advise the company that you're enrolled in the QMB program. medicare insurance broker. If you have actually made a payment while signed up in the program, you're entitled to a refund. While QMB is provided by your state Medicaid firm, it's a separate program from Medicaid and provides different insurance coverage.

It's crucial to know, nonetheless, that certain amounts of income are not counted in establishing QMB eligibility - medicare supplement plans comparison chart 2021. Particularly if you are still working and also the majority of your earnings comes from your earnings, you may have the ability to qualify as a QMB even if your total revenue is practically two times the FPG.

If, after using these guidelines, the number you get to is anywhere near the QMB qualifying restriction (in 2020, $1,083 in month-to-month countable revenue for an individual, $1,457 for a couple), it is worth applying for it. (The restrictions are somewhat higher in Alaska and Hawaii.) Possession Purview There is a limit on the value of the properties you can own and still certify as a QMB (medicare supplement plans comparison chart 2021).

Since the SLMB and also QI programs are for individuals with greater earnings, they have less advantages than the QMB program. The SLMB and QI programs pay all find more or part of the Medicare Component B month-to-month costs, however do not pay any type of Medicare deductibles or coinsurance amounts. Nonetheless, this implies potential financial savings of greater than a thousand bucks each year.

Our Shingles Vaccine Cost Ideas

If you are located disqualified for one program, you might still be located eligible for one of the others. Where to File To qualify for the QMB, SLMB, or QI programs, you should submit a composed application with the agency that handles Medicaid in your stateusually your area's Department of Social Services or Social Welfare Division.

A Medicaid eligibility employee could require extra specific information from you, you will at the very least be able to get the application process started if you bring: pay stubs, income tax returns, Social Safety advantages information, and also various other evidence of your current income documents revealing all your financial savings as well as other financial possessions, such as bankbooks, insurance plans, and also supply certificates automobile enrollment documents if you possess a cars and truck your Social Safety and security card or number details concerning your spouse's revenue and different properties, if the two of you live with each other, and also medical bills from the previous three months, as well as clinical records or reports to validate any kind of medical condition that will certainly need therapy in the close to future.

Ask concerning the treatment in your state for getting a hearing to appeal that choice. At an appeal hearing, you will have the ability to offer any kind of documents or other papersproof of income, properties, medical billsthat you believe sustain your insurance claim. You will certainly also be enabled to clarify why the Medicaid decision was wrong.

You are allowed to have a good friend, relative, social employee, legal representative, or other representative show up with you to assist at the hearing. The precise treatment for acquiring this hearing, and also the hearing itself, might be slightly various from state to state, they all resemble really carefully the hearings provided to candidates for Social Security advantages.

Medicare Supplement Plans Comparison Chart 2021 Can Be Fun For Anyone

Getting Help With Your Appeal If you are refuted QMB, SLMB, or QI, you may desire to seek advice from with somebody experienced in the subject to assist you prepare your charm. One location you can discover top quality complimentary help with these issues is the nearby workplace of the State Health Insurance Policy Help Program (SHIP).